Wynn Resorts Q1 2025 Revenue Falls to $1.70 Billion as VIP Weakness Hits Earnings

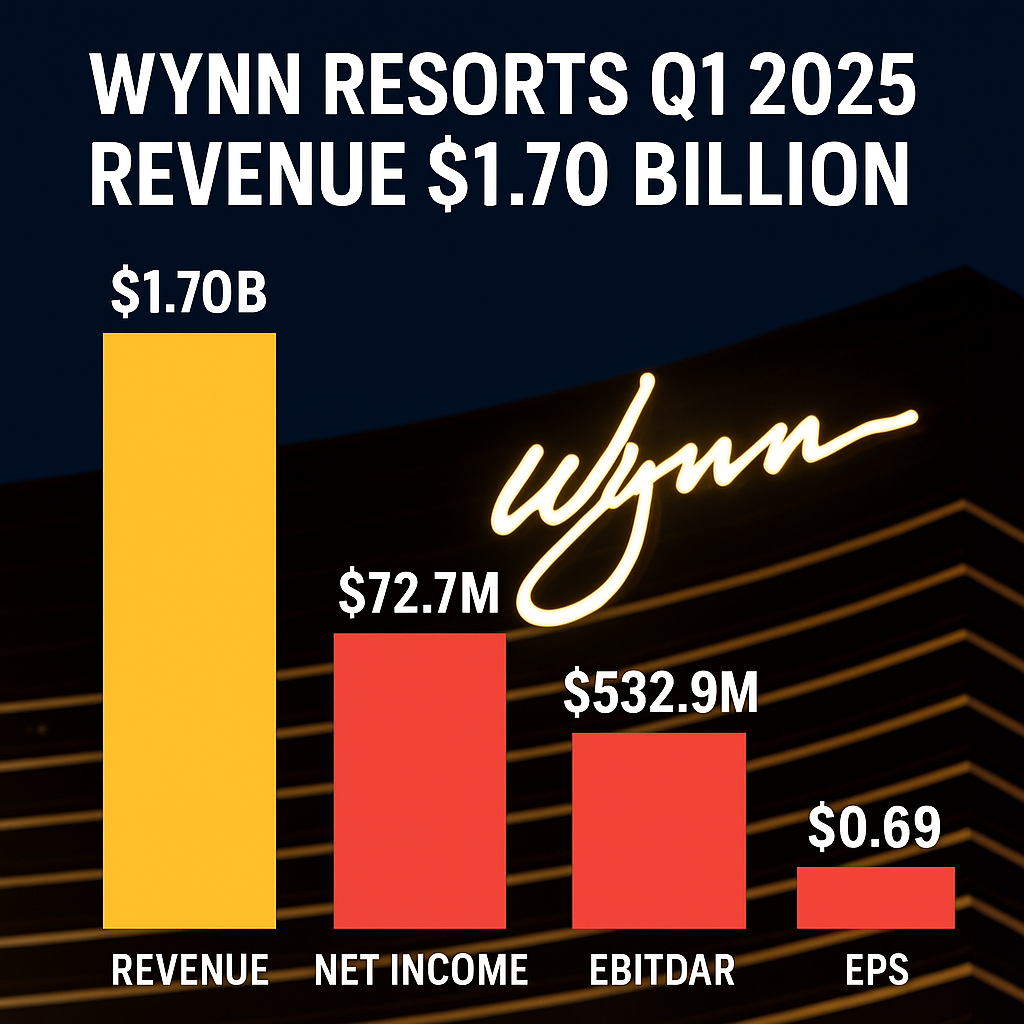

Wynn Resorts has reported Q1 2025 revenue of $1.70 billion, marking an 8.7% decline year-on-year, as weaker VIP hold rates in Macau and elevated comps from last year’s Super Bowl weigh on performance.

Net income dropped 49.6% to $72.7 million, with diluted EPS falling 46.9% to $0.69. Adjusted Property EBITDAR decreased 17.6% to $532.9 million.

The quarter marks a transitional period for the operator, following record performance in early 2024.

Macau VIP Win Rates Fall Below Range

Wynn’s Macau operations showed broad declines across both major properties:

Wynn Macau revenue dropped 19.9% to $330.0 million

Adjusted EBITDAR declined 34.3% to $90.2 million

VIP win percentage fell to 1.09%, well below the expected 3.1%–3.4% range and Q1 2024’s 3.39%

Wynn Palace reported an 8.7% revenue decline to $535.9 million and a 20% drop in EBITDAR to $161.9 million. VIP win softened to 2.61% from 3.30%, while mass table win improved slightly to 24.8%, up from 24.5%.

Las Vegas Results Normalize After 2024 Spike

Las Vegas properties remained stable after Q1 2024's Super Bowl surge:

Revenue down 1.8% to $625.3 million

EBITDAR fell 9.3% to $223.4 million

Table games win rate came in at 24.3%, compared to 25.9% in Q1 2024

Despite the decline, performance remains within the expected 22%–26% range for table games.

Encore Boston Harbor Sees Modest Decline

In Massachusetts, Encore Boston Harbor posted a 4% revenue decline to $209.2 million. EBITDAR dropped 8.9% to $57.5 million. Table games win slipped from 22.6% to 20.5%, though remained in the normal operating range.

Progress Continues on Wynn Al Marjan Island

Wynn’s upcoming UAE property, Wynn Al Marjan Island, reached its 47th floor of vertical construction during the quarter. The operator contributed another $51.2 million to the project, pushing total investment to $682.9 million.

The property is scheduled to open in 2027, marking Wynn’s first expansion into the Middle East.

Shareholder Returns Continue

Wynn returned $200 million to shareholders through the repurchase of 2.36 million shares at an average price of $84.76. The company also declared a quarterly dividend of $0.25 per share, payable on May 30, 2025.

At the end of the quarter, Wynn retained $613 million in repurchase authority.

FY2024 Context and Outlook

Wynn ended 2024 with $7.13 billion in revenue, up 9.1% year-on-year, driven by a 14.6% gain in Macau. Net income for the year came in at $501.1 million, a 31.4% drop due to tax normalization and fewer one-off gains.

Q4 2024 results, which were largely flat, hinted at a slowdown. The Q1 2025 figures confirm softer VIP demand and tougher year-on-year comparisons, although core operations appear stable.

TYPO3 Media Analysis

Wynn’s Q1 2025 results illustrate the risks of VIP segment volatility and event-driven peaks. The overall business remains healthy, with mass gaming showing resilience and U.S. operations holding steady.

The company continues to invest internationally while maintaining its capital return program — a sign of confidence despite near-term softness.

We will continue tracking Wynn’s performance into Q2, especially regarding Macau recovery trends and development milestones in the UAE.